African Nations Face Growing Debt Crisis and Default Risk

Over the past decade, China has lent more than $17 billion to Ghana for various infrastructure projects, ranging from hydroelectric developments to broadband internet systems. As China’s lending practices have expanded, so has Ghana’s debt, placing the West African nation at the forefront of a recent analysis of countries at risk of default.

Ghana’s Debt Crisis

The latest Bloomberg Sovereign Debt Vulnerability Ranking reveals a troubling scenario for Ghana. According to this ranking, which evaluates countries based on their debt burden and default risk, Ghana tops the list of African nations with severe debt issues. Two primary factors contribute to Ghana’s leading position on this list: its government debt now equals nearly 85% of the country’s gross domestic product (GDP), and interest payments on this debt amount to 7.2% of Ghana’s GDP. These high ratios highlight the country’s precarious financial situation.

Among the 13 African countries on the list, eight have government debt equal to 70% or more of their GDP. Such high debt-to-GDP ratios place nations at significant risk of default and can severely limit their ability to secure additional funding.

The Impact of Chinese Lending Practices

According to Brad Parks, executive director of AidData, a research group tracking Chinese lending in Africa, the continent’s borrowing capacity is rapidly diminishing. Parks recently discussed these concerns with the Peterson Institute for International Economics. He emphasized that countries are no longer able to absorb additional debt due to their already high debt burdens.

About 90% of China’s loans to African countries are non-concessional, meaning they are provided at market interest rates. These loans are typically issued by state-owned commercial banks such as the China Development Bank and the China Export-Import Bank, featuring interest rates around 4% and a repayment period of 10 years. In contrast, loans from the Organization for Economic Co-operation and Development (OECD) generally offer much more favorable terms, including a 1% interest rate and a 28-year repayment period.

While some Chinese loans have been used for government projects with no commercial return, China has recently announced plans to forgive interest-free loans to 17 African countries. However, commercial loans are subject to individual renegotiation, as China has resisted offering blanket debt relief.

Potential Consequences: A Look at Sri Lanka and Beyond

As countries approach the brink of default, there is growing concern that China might seize control of key infrastructure projects used as collateral for these loans. Sri Lanka provides a cautionary tale. Initially benefiting from Chinese financing under the Belt and Road Initiative, Sri Lanka saw the construction of the Port of Hambantota, which opened in 2010. By 2016, the port struggled with debt repayment issues, leading to a 99-year lease to China Merchants Port and a 70% stake in operations. In May 2022, Sri Lanka defaulted on its $50 billion international debt.

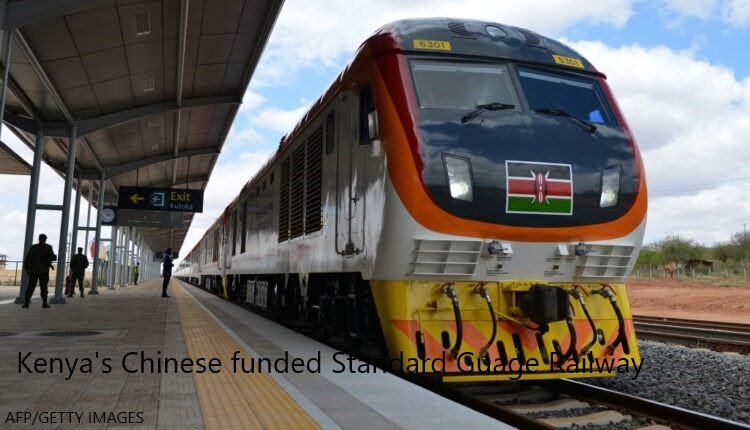

In Africa, Kenya’s Standard Gauge Railway, funded by Chinese loans, faces similar financial troubles. The railway, which connects Mombasa and Nairobi, generated only $13 million in income in 2021, while its annual loan payment increased to $806 million.

Zambia, another significant borrower, owes China $5.78 billion. The country recently canceled $2 billion in new projects to avoid additional commercial debt and had already defaulted on part of its debt in 2020.

China’s Changing Approach to Lending

As many of its long-time borrowers approach financial insolvency, China is altering its lending strategy but maintaining its underlying philosophy. According to Parks, China has shifted from project-based lending to balance of payments lending. This means that China now provides loans to help countries manage their existing debt.

China’s new loans come with even higher interest rates and shorter terms, sometimes as brief as a few months. Instead of commercial banks, these loans are increasingly issued by the People’s Bank of China, the country’s central bank, whose loan volumes have surged.

Despite this shift, new loans do not guarantee improved financial stability. Sri Lanka’s experience, where short-term loans totaling $4 billion did not prevent default, underscores the risks associated with increasing debt under difficult conditions.

The Risks of Excessive Debt

Brad Parks cautions that adding more debt in cases of solvency issues, rather than liquidity problems, can exacerbate financial difficulties. The reliance on expensive debt for struggling nations may only worsen their economic situation.